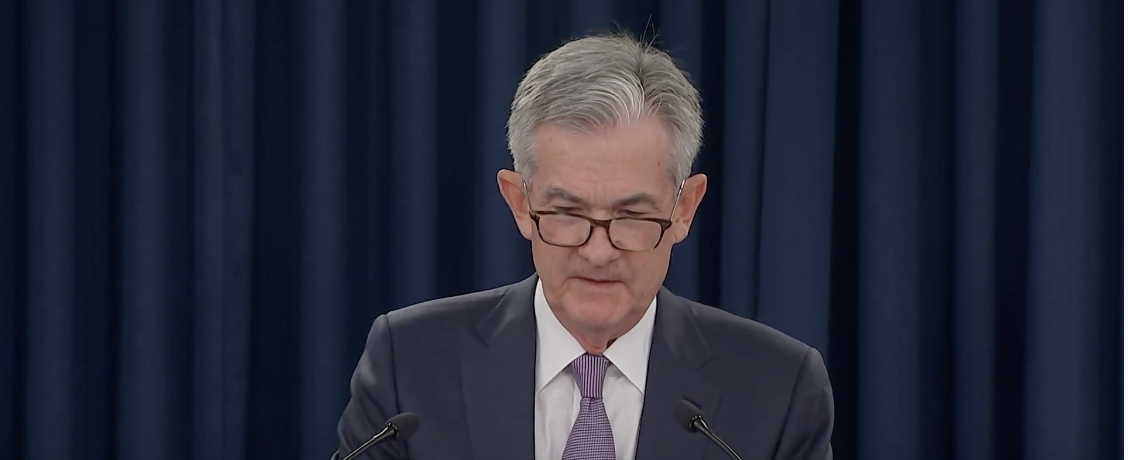

The Federal Reserve voted 7-3 yesterday to lower interest rates a quarter of a percent to 2%. Federal Reserve Chairman Jerome Powell announced that “We took this step to help keep the U.S. economy strong in the face of some notable developments and to provide insurance against ongoing risks.” He also went on to say, “Since the middle of last year, the global growth outlook has weakened, notably in Europe and China. Additionally, a number of geopolitical risks, including Brexit, remain unresolved. Trade policy tensions have waxed and waned, and elevated uncertainty is weighing on U.S. investment and exports.” You can read the full transcript here.

- The people who voted for the rate cut were:

- Federal Reserve Chairman: Jerome Powell

- Federal Reserve Vice Chairman: Richard H. Clarida

- Federal Reserve Vice Chairman for Supervision: Randal K. Quarles

- President of The Federal Reserve Bank of New York: John C. Williams

- President of The Federal Reserve Bank of Chicago: Charles L. Evans

- Chair of the Committees on Financial Stability, Federal Reserve Bank Affairs, Consumer and Community Affairs, and Payments: Lael Brainard

- Michelle W. Bowman

- The people who voted against the rate cut were:

- President of The Federal Reserve Bank of St. Louis: James Bullard – Wanted to lower interest rate to 1.75% or 1.5%

- President of The Federal Reserve Bank of Kansas City: Esther L. George – Wanted to keep the rate unchanged

- President of The Federal Reserve Bank of Boston: Eric S. Rosengren – Wanted to keep the rate unchanged

At first President Trump said, “Jay Powell and the Federal Reserve Fail Again. No “guts,” no sense, no vision! A terrible communicator!” But later in the day said, “I think it’s fine. I think that frankly, they should have acted faster.”

The market responded with mixed feelings. The Dow closed up 36.28 points. The Nasdaq closed down 8.62 points. The S&P 500 closed up 1.03 points.