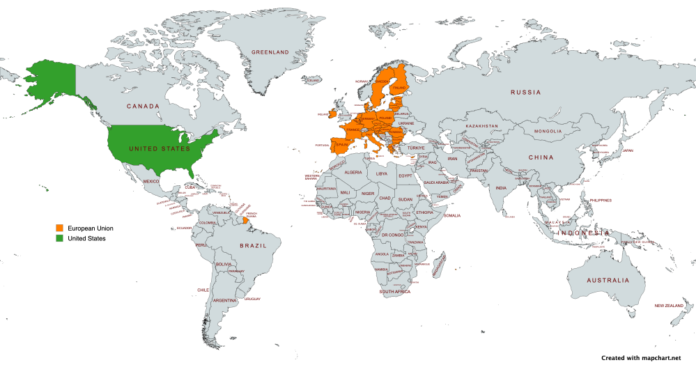

The United States and the European Union have announced a major trade framework following talks in Scotland, with both sides touting the agreement as a step toward economic stability. However, reactions have been mixed, as the deal leaves many questions unresolved and imposes new tariffs on a wide range of goods.

Under the terms of the agreement, the US will impose a 15% tariff on most goods imported from the EU—half the rate originally threatened by President Donald Trump. In return, the EU has pledged $600 billion in investments in the US and agreed to purchase $750 billion in American energy products, including oil, liquefied natural gas, and nuclear fuel. The pact also eliminates tariffs on some strategic items like aircraft components, semiconductors, certain chemicals, and select agricultural products.

While President Trump praised the outcome, calling it the largest deal of its kind and a victory for American industries, European leaders have expressed concern over its impact. French Prime Minister Francois Bayrou criticized the agreement as a concession, stating it was a troubling day for transatlantic unity. Germany’s Chancellor Friedrich Merz offered more measured support, noting the deal helped avoid a damaging trade conflict, especially for Germany’s export-driven economy.

The automotive sector is among the most directly affected. German car manufacturers face a reduction in tariffs from 27.5% to 15%, which, while lower, still represents a challenge. Industry groups warned that even at 15%, the tariff burden will cost billions and further strain margins. Meanwhile, American carmakers stand to benefit from the EU dropping its tariff on US-made cars from 10% to 2.5%, although domestic complexities in car assembly across North America may temper that advantage.

European pharmaceutical companies were also caught in a web of conflicting statements. Trump initially claimed drugs were excluded from the tariff schedule, but EU leaders and US officials later confirmed that they were included. This ambiguity has left pharmaceutical exporters uncertain, especially those in Ireland and Denmark, where products like diabetes medications enjoy a strong foothold in the American market.

Another point of contention involves the steel and aluminum industries. The US will maintain its 50% tariff on these materials for now, though EU officials hope to negotiate a quota system to ease the burden.

Markets responded positively in the immediate aftermath. European stock indexes climbed, driven by relief that a trade war was averted. However, analysts cautioned that the agreement’s lack of detailed implementation plans means risks remain. Businesses and policymakers will need to navigate further negotiations, with an updated joint statement expected by August 1.

Despite broad declarations of success, the reality is more complex. The deal offers short-term stability, but the longer-term effects—particularly for consumers and exporters—are still being evaluated. With tariffs staying well above prior levels and major investments yet to take shape, many in Europe are hesitant to celebrate. Further negotiations will determine whether the framework evolves into a more equitable trade relationship or leads to continued disagreement.

Green = USA

Orange = European Union

Image is licensed under the Creative Commons Attribution-Share Alike 4.0 International license and was created using MapChart (https://mapchart.net).