Tensions between Washington and New Delhi are escalating after U.S. President Donald Trump warned that India could face steep increases in tariffs due to its continued purchases of Russian oil. The statement adds new pressure to an already strained trade relationship, as India maintains that its energy policies are driven by necessity and its own economic interests.

Trump’s warning comes amid his administration’s push to penalize countries that engage in energy trade with Moscow. He has argued that nations buying Russian oil are indirectly supporting the ongoing war in Ukraine. The United States has already announced a 25% tariff on Indian imports, and Trump indicated that additional measures would follow if India does not curb its Russian energy purchases. He has not yet clarified the exact scale of the new penalties.

India has defended its position by emphasizing that it turned to Russian oil only after the global energy market was disrupted by the Ukraine conflict. Traditional suppliers diverted shipments to Europe, and India, heavily dependent on imported fuel, sought alternative sources to keep domestic prices stable. Indian officials have repeatedly said that their oil refiners operate independently, basing purchases on price, reliability, and supply security, and that these imports have helped prevent global price shocks.

New Delhi also pushed back against U.S. criticism by highlighting that Western nations, including the United States and the European Union, continue to trade certain goods with Russia despite public calls for sanctions and restrictions. Indian officials argue that their purchases are a matter of national necessity, while some Western trade with Russia serves industrial or commercial interests rather than energy security.

Trade experts note that India has become the largest buyer of Russian seaborne crude, importing roughly 1.7 to 1.8 million barrels per day over the first half of 2025. This represents a dramatic increase from pre-2022 levels, when Russian oil accounted for just a small fraction of India’s imports. By contrast, U.S.-Russia trade has dropped sharply but still exists in sectors such as specialized chemicals, metals, and nuclear fuel.

The escalating tariff threats come at a time when both countries have struggled to advance a comprehensive trade agreement. Longstanding disagreements over agricultural access, market protections, and industrial tariffs have delayed progress. Trump has repeatedly labeled India’s tariff structure as too high and argued that the U.S. is seeking a fairer balance in trade relations.

Analysts believe India is unlikely to halt Russian oil imports entirely, given the scale of its energy demand and the country’s priority of keeping consumer costs manageable. However, the risk of new U.S. tariffs poses economic and diplomatic challenges for Prime Minister Narendra Modi’s government. India could face pressure to diversify its suppliers further while also protecting its domestic industries from potential export losses if U.S. duties take effect.

For now, New Delhi insists it will safeguard its national interests and economic security, while Washington signals that trade penalties remain on the table. The standoff highlights the difficult balance between energy needs, geopolitical alliances, and the economic risks of a growing tariff confrontation.

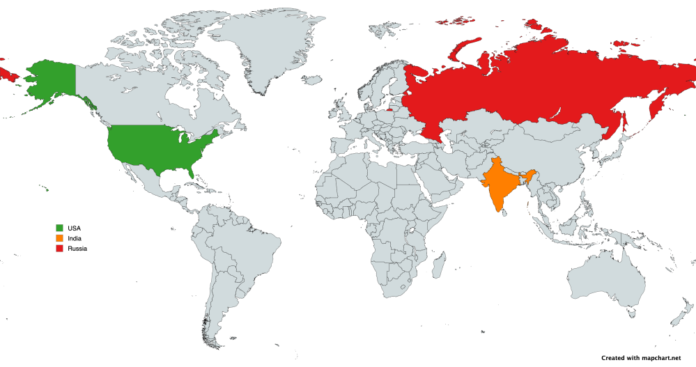

Green = USA

Orange = India

Red = Russia

Image is licensed under the Creative Commons Attribution-Share Alike 4.0 International license and was created using MapChart (https://mapchart.net).