Nvidia has become the first company in history to reach a $5 trillion market valuation, a milestone that highlights how artificial intelligence has reshaped global markets and cemented the California-based chipmaker’s dominance at the center of the AI revolution. The company’s stock rose over 3% on Wednesday to close at $207.04, adding billions to its market value and lifting CEO Jensen Huang’s personal wealth to roughly $179 billion.

The surge follows a series of new partnerships and announcements that have further solidified Nvidia’s control over the AI hardware market. At the company’s annual AI conference in Washington, D.C., Huang unveiled plans for $500 billion in AI chip orders, new collaborations with Uber and Nokia, and a $1 billion investment to help develop 6G technology. Nvidia also confirmed it will partner with the U.S. Department of Energy to build seven new AI supercomputers aimed at advancing national research capabilities.

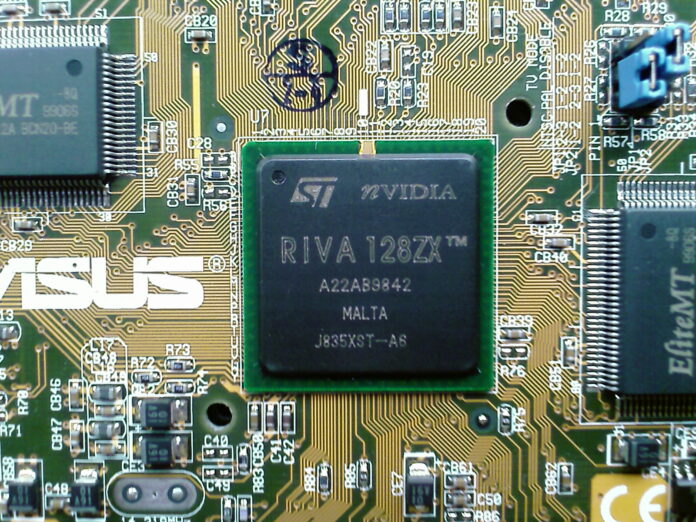

Founded in 1993, Nvidia began as a niche designer of graphics processing units (GPUs) for gaming. Today, its H100 and Blackwell processors are the primary engines powering large language models such as ChatGPT, as well as the infrastructure behind Elon Musk’s xAI and other advanced computing systems. The company’s success has been driven by its ability to adapt GPU technology for massive AI workloads—transforming what was once gaming hardware into the backbone of machine learning and data processing.

Since the launch of ChatGPT in 2022, Nvidia’s share price has climbed more than 1,500%, far outpacing the broader S&P 500 and Nasdaq indexes. The company’s current value now exceeds the combined market capitalizations of its rivals AMD, Intel, Broadcom, Qualcomm, TSMC, and Micron. Its growth has also placed it ahead of Apple and Microsoft in terms of valuation momentum, with both companies recently surpassing $4 trillion.

Nvidia’s meteoric rise has sparked concerns among economists and central bankers about a potential AI-driven market bubble. The Bank of England and International Monetary Fund have each warned that enthusiasm surrounding AI stocks could lead to inflated valuations similar to those seen during the dot-com era. Still, Huang has dismissed the idea, stating that “these companies are generating real revenues” and that AI products “are profitable and reshaping industries.”

Geopolitical tensions have also followed Nvidia’s success. The company’s Blackwell chip has become a central topic in discussions between President Donald Trump and Chinese President Xi Jinping, as U.S. export restrictions continue to limit Beijing’s access to advanced AI hardware. While the Trump administration has at times relaxed some trade limits, it remains cautious about allowing China to acquire top-tier computing technology.

Nvidia’s influence now extends well beyond Silicon Valley. Its hardware powers global research in healthcare, renewable energy, robotics, and autonomous vehicles. The company’s dominance has also made it a critical part of Washington’s national security agenda, with growing emphasis on maintaining an edge over China’s expanding semiconductor industry.

As the AI boom continues, Nvidia’s trajectory represents both technological progress and market transformation. Whether the rally proves sustainable or faces correction, its impact on global computing, economics, and geopolitics is already reshaping the foundation of modern technology.

Image is in the public domain an was created by Hyins.